Kerrisdale Capital is long Telephone and Data Systems Inc (NYSE:TDS), a $4.8 billion telecom holding company that spent most of the last decade stuck in a narrative so convoluted that investors largely stopped trying to unravel it.

A shrinking regional wireless carrier consumed capital and oxygen, the wireless business inched toward a fiber future it could not aggressively fund, and the company’s remaining assets – spectrum, towers, minority wireless interests – sat trapped inside a corporate structure that made unlocking them feel academic at best. Even when the pieces were clearly worth more than the whole, the whole stubbornly refused to change.

And then it did.

With the $4.3 billion sale of US Cellular in August, TDS shed the burden that had defined it for years. What has emerged is a company almost unrecognizable from the one analysts still believe they are covering: a clean balance sheet, two operating businesses with straightforward economics, and spectrum assets that are finally being turned into cash. TDS Telecom is scaling fiber into markets deliberately chosen for competitive advantage, and Array Digital’s tower business is being run as an actual tower platform rather than a reluctant appendage to rural wireless coverage. The “other assets” that once muddled the story now strengthen it. Billions in spectrum are being sold to AT&T, Verizon, and T-Mobile, and minority wireless partnerships continue to throw off cash with machine-like regularity.

Crucially, the company is deploying the proceeds exactly as it should. Management fortified the balance sheet, accelerated fiber builds where returns justify more capital, and recently announced a $500 million share repurchase authorization – the clearest signal management understands intrinsic value and is aligned with shareholders to act on it.

The operational engines powering TDS’s next leg of transformation are already in motion. Expansion fiber markets are advancing along predictable penetration curves. FCC subsidies are accelerating the conversion of legacy copper territories into fiber with limited competitive overlap. And the tower business – freed from wireless obligations and now managed as an independent infrastructure platform – has a long runway for tenancy growth and cost rationalization.

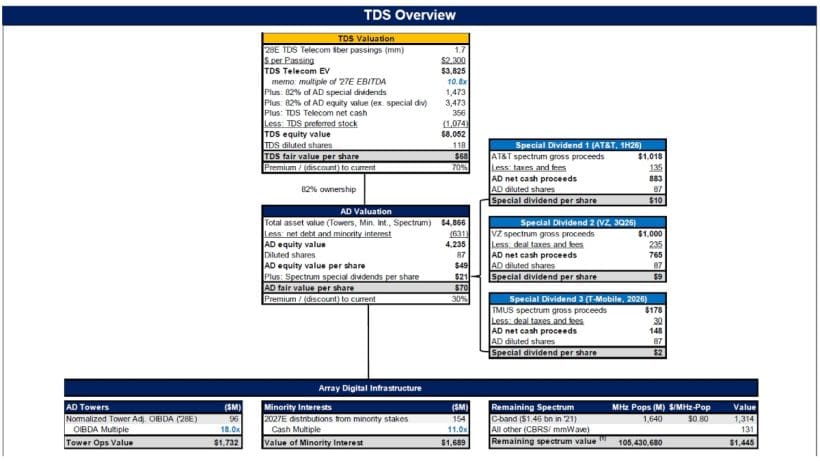

In the coming quarters, as fiber passings rise, tower margins normalize, a staggering $1.5 billion in special dividends – worth over 30% of the current stock price – is received, and new segment-level disclosures bring additional clarity, the punitive discount rooted in an outdated view of TDS should finally begin to disappear. TDS is making the transition from copper to fiber; now the market needs to upgrade its connection. Our fair value estimate is $68, representing 70% upside.

Investment Highlights

TDS is not the convoluted sum-of-parts investors remember. With the sale of US Cellular, the company has been reset around two straightforward businesses: TDS Telecom, a rapidly scaling fiber platform, and through 82%-owned Array Digital Infrastructure (Array Digital or AD), an independent tower platform with meaningful tenancy and margin upside. The balance sheet is clean, execution risk is far narrower, and capital allocation is no longer a tug-of-war with a chronically subscale wireless business. Beneath these operations sit two equally simple financial assets: a spectrum portfolio in full monetization mode, set to deliver billions in special dividends, and a set of mature wireless partnerships that distribute steady cash like an ATM. As fiber penetration builds, tower performance normalizes, billions in announced special dividends arrive, and more granular segment-level reporting begins in February, the substantial discount to fair value should unwind.

TDS’s first-to-fiber expansion strategy smartly avoids competition while building a moat. Beginning in 2022, TDS began deploying fiber in Tier-2 and Tier-3 communities that were too small for national carriers to prioritize yet large enough to deliver attractive returns to the first scaled builder. The company targeted roughly one hundred of these markets – places like Fond-du-lac, Wisconsin and Great Falls, Montana – where TDS could become the first gig-capable provider of meaningful scale and face muted response from incumbents. Penetration then rises in a predictable pattern as build phases complete, neighborhoods fill in, and word-of-mouth spreads. Expansion market broadband connections have nearly doubled in two years and, when combined with growth from newly launched E-ACAM markets, should increasingly offset declines in legacy copper and cable. As more of the footprint becomes fiber and as expansion markets move toward maturity, TDS’s wireline revenue mix, margin profile, and cash flows should inflect favorably.

E-ACAM converts TDS’s ILEC footprint into a defensible fiber franchise. The FCC’s E-ACAM subsidy program delivers TDS fifteen years of predictable, high-margin wholesale revenue – over $1.2 billion in total – providing for the upgrade of roughly 300,000 rural copper locations to fiber at infrastructure IRRs. These are markets where TDS is the only eligible participant, deterring competition and enabling penetration targets in the 65%-75% range. We think investors are underestimating the program’s significance. It replaces legacy copper economics with long-duration fiber cash flows and structurally lowers competitive risk. The program is already underway in 16 states and pulls the company’s broadband mix toward fiber faster than consensus expectations.

TDS’s approach sits within a broader national broadband infrastructure buildout cycle. The national carriers have already made the strategic call: fiber is the long-term broadband platform, and they are racing to scale it. AT&T is targeting roughly 60 million fiber passings by 2030, Verizon expects 30+ million by 2028 on its way to 35-40 million, and even T-Mobile – despite leaning on fixed wireless – has secured its fiber position through investments in Metronet, Lumos, and open-access partnerships. These are decade-defining capital commitments from the industry’s largest players. In that context, TDS’s fiber build is not only organically beneficial but increases strategic value in the midst of an M&A market where mid-sized residential fiber footprints exactly like TDS’s are being gobbled up at premium multiples.

Array Digital’s tower business is finally allowed to operate like a tower business. Prior to the sale of US Cellular, Array Digital’s tower portfolio had been undermarketed; its value trapped inside a wireless carrier focused on providing rural coverage, not maximizing cash yield. That constraint is gone. In the third quarter, the early effects of a more commercial posture began to show, with site leasing revenue increasing 10% organically and new tenant applications up 125% year-to-date. Tenancy ratios sit at just over 1.0x, while scaled peers average over 2.2x. The path to better topline and profitability is straightforward: aggressively lease the space that already exists, rationalize uneconomic ground leases, and reduce wind-down costs that still make up 40% of SG&A, thereby allowing the business to operate with a true tower company margin structure. This is not complicated financial engineering. This is simply what happens when a tower business is finally allowed to be one. Investors should be looking through this period of cost rationalization and not valuing the business as if it is permanently impaired at 2026E sub-30% EBITDA margins.

Spectrum and minority interests provide two attractive pools of value that the market persistently discounts. TDS is no longer a wireless operator and spectrum is now a financial asset being monetized in orderly steps. More than $1 billion in proceeds from AT&T has already received regulatory approval, with another $1.2 billion from Verizon and T-Mobile expected to close by the third quarter of 2026. After taxes and fees, roughly $1.8 billion in special dividends will be distributed to AD shareholders, of which TDS will receive its 82% share. This represents an extraordinary capital return – about $21 per AD share and worth $12 per TDS share – equal to 38% and 31% of their respective current stock prices.

The minority interests, meanwhile, are stable, low-risk cash distributions from partnerships dominated by four entities, including TDS’s stake in Verizon’s Los Angeles MSA. These assets require no capex, have no operational risk, and produce more than $150 million in annual cash distributions like clockwork.

AD investors are getting $21 in special dividends for free. The market-implied valuation of AD embeds a combination of discounts across its asset base: towers valued at barely 12x consensus EBITDA despite a normalized structure deserving 17–20x, minority interests marked at levels inconsistent with the quality and reliability of those cash distributions, and C-band spectrum treated as if there wasn’t active interest in the swath during the strategic review. A more defensible valuation using 18x for normalized tower EBITDA and 11x for minority distributions produces a fair value around $50 per share for AD, within shouting distance of the current market price before including $21 in announced special dividends expected to be paid within just 9 months. The market is effectively giving away $21 per share for free.

Read the full report here by Kerrisdale Capital