Kerrisdale Capital is short shares of Affirm Holdings, Inc. (NASDAQ:AFRM).

We are short shares of Affirm Holdings (AFRM), a $25 billion "Buy Now, Pay Later" lender built on the same subprime playbook that has undone monoline consumer finance companies for decades. Since 2022, Affirm's GMV has grown at a 33% CAGR and its stock has risen nearly eightfold from the lows. But this is scale without quality and growth without durability. Expansion has been driven by aggressive credit extension to weak-credit borrowers and by extracting more borrowing from repeat users who are increasingly financing necessities rather than discretionary purchases. When a business shifts from financing Pelotons to installment plans for groceries, it is no longer "democratizing credit" but rather levering the financially fragile. As labor conditions soften and credit normalizes, the illusion of resilience will fade, exposing a balance-sheet lender built for expansion, not endurance. President Trump's recent call to rein in high-cost consumer credit now places Affirm's model under direct political scrutiny.

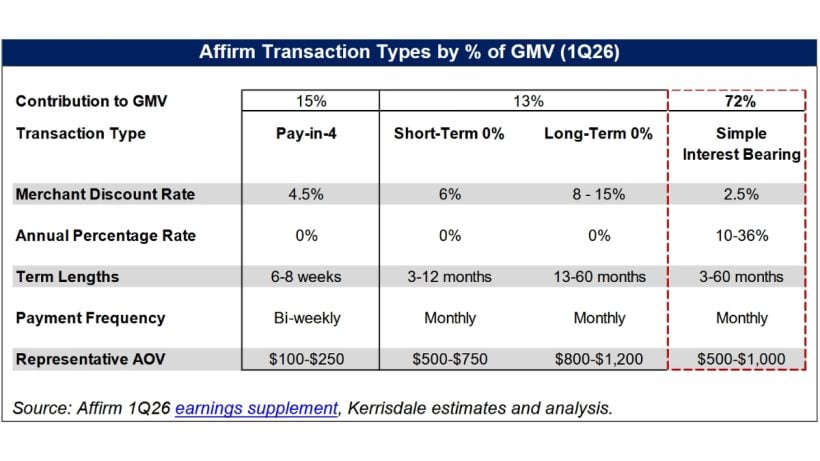

While often treated by US investors as a bellwether for BNPL, Affirm is in fact an outlier. Roughly half of its revenue comes from interest income generated by high-APR installment loans, with virtually all interest-bearing balances priced above 10% and the largest bucket north of 30%. That reliance on consumer interest income is unique among major BNPL players and far greater than at peers like Klarna, where revenue is driven primarily by merchant fees. It also takes on new relevance following Trump's move to cap credit card APRs at 10%, condemning lenders charging "20 to 30%, and even more." In a bid to produce a sliver of profit, Affirm's pricing has only marched higher in recent years: its average yield on interest-bearing loans is now 31%, higher than many credit card issuers now in political crosshairs, and a prime example of the ever-rising rates Trump says have "festered unimpeded" and "ripped off" Americans. Even if the rhetoric is presently aimed at credit cards, the substance of the debate ahead of the midterms is about affordability and the impact of high-interest consumer lending, which is exactly where Affirm has centered its business.

That concentration matters because Affirm has no margin for error. Recent results have been flattered by an unusually forgiving credit backdrop. For the past three years, low unemployment and suppressed losses have allowed the company to stretch its balance sheet and barely scrape into GAAP profitability. Today, Affirm is levered over 6x, with credit reserves equal to just 1% of GMV and roughly 2% of retained credit risk – a woefully thin cushion for a borrower base that historically produces 6-7% loss rates in normal conditions. As employment softens, losses will rise, reserves will have to be rebuilt, and growth will slow sharply. A retreat from 40%+ GMV growth would unravel a valuation that assumes near-perfect execution, pushing earnings back into the red and forcing a repricing toward book value of just $9 per share.

Read our full report here.