A New York state court has temporarily blocked Xerox's merger with Fujifilm and reopened the company’s nomination window, dealing a victory to activist investor Darwin Deason, who plans to nominate a full slate for election to Xerox’s board. Deason partnered with Carl Icahn to upend the deal, contending that a sale of the entire printer manufacturer would deliver better value to shareholders.

Q1 hedge fund letters, conference, scoops etc

Xerox said it plans to appeal the decision and reopened talks with Fuji about an increase to the Japanese firm’s bid. The U.S. company said it believes the combination is “the best path forward" for shareholders. "Xerox disagrees with the court’s ruling to enjoin the shareholder vote on our proposed combination with Fuji Xerox and to waive the advance notice bylaw," the company said in a statement. "The company strongly believes that its shareholders should be allowed to exercise their right to vote on the transaction and decide for themselves."

Xerox will probably hold its annual meeting before its extraordinary meeting, meaning that a new board could be elected before the transaction is completed. If Deason and Icahn succeed in appointing directors to the board, a merger may become an even less likely outcome for Xerox.

What we'll be watching for this week

- Will Tesla reveal key Model 3 data when it reports earnings Wednesday including the impact of a mid-April temporary halt in production at its main factory?

- Will Change to Win Investment Group (CtW) succeed Thursday in ousting three incumbent Equifax directors who it believes are responsible for the company’s 2017 data breach?

- Will Elliott Management gain control of Telecom Italia’s board and overthrow top shareholder Vivendi at the company’s extraordinary meeting Friday?

Activist shorts update

China Internet Nationwide Financial Services (CIFS) announced the completion of its internal investigation into the allegations raised by Muddy Waters Research, noting that there was no truth to the short seller’s accusations. In December, Muddy Waters accused CIFS of being “just another worthless China fraud,” claiming that the China-based, New York-listed company falsely disclosed borrowers associated with 84.2% of its loans. CIFS’ independent special committee announced on Monday that all the company’s loans were verified.

Muddy Waters, however, was not convinced. “$CIFS faux investigation shows why attorney-client privilege in public company fraud investigations is damaging to markets. Everything is shrouded in the privilege, and the company gets to announce basically what it wants to announce,” the short seller tweeted. Nonetheless, CIFS shareholders did not share Muddy Waters’ view; the company’s stock price rocketed as much as 11% on news of the probe results.

Even so, shares in CIFS still trade nearly 31% lower since the release of Muddy Waters’ negative report.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

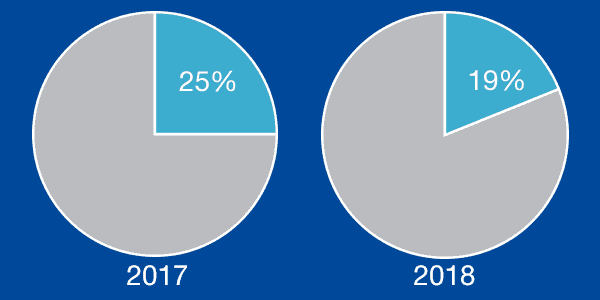

Chart of the week

The number of U.S.-based companies publicly subjected to activist demands in the financial sector, as of April 27.

For bespoke data requirements, contact our team at support@activistinsight.com or subscribers of Activist Insight Online can visit our interactive statistics page.

Article by Activist Insight