The second quarter was a difficult one for many hedge funds as value stocks continued to struggle, and although June was an improvement over May, funds generally underperformed. The July Eurekahedge Report shows that overall in June, hedge funds ticked down more than underlying markets, on average.

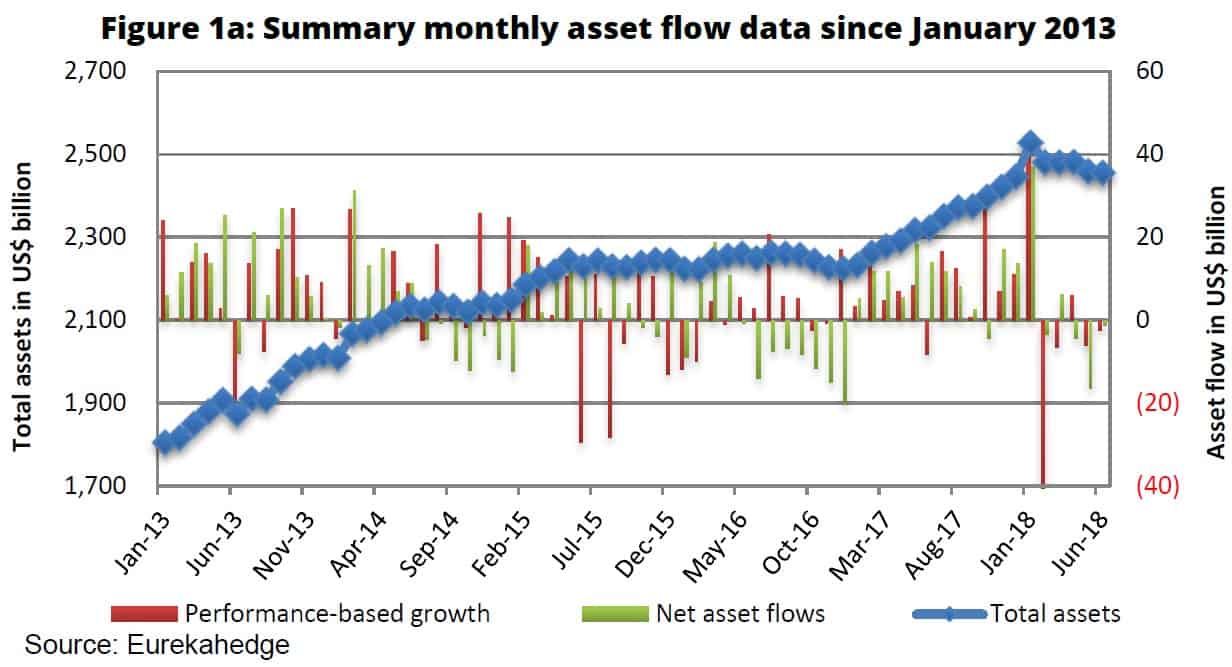

Hedge fund AUM roughly flat in June

The Eurekahedge Hedge Fund Index declined 0.34% in June, compared to a decline of 0.21% in the MSCI World Index. Unsurprisingly, event-driven hedge funds gained the most last month, rising an average of 1.17%. In the first six months of the year, performance-based gains for event-driven hedge funds amounted to $3.3 billion, while net investor inflows reached $4.4 billion. Relative value funds were in second place...