Long/ short equity hedge funds have been making a comeback in terms of inflows this year, but they have turned a corner. Investors who have been pouring money into long/ short equity funds are finally starting to see returns on that capital.

Long/ short equity hedge funds are back

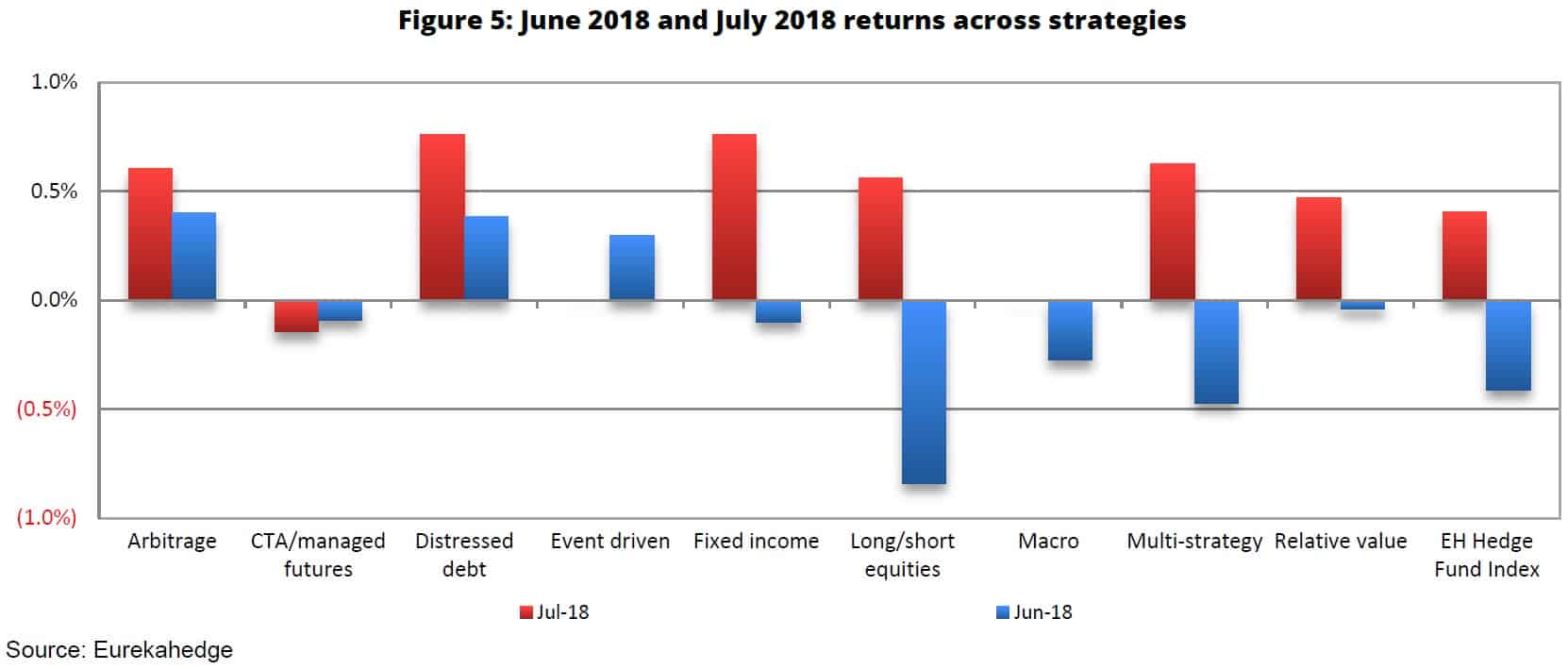

According to Eurekahedge's August update, long/ short equity hedge funds have recorded $11.3 billion in performance-based gains year to date, coming out significantly ahead of all other hedge fund strategies. The worst-performing strategy so far this year is CTA/ managed futures, which stands at $18.2 billion in performance-based declines.

CTA hedge funds are still trying to make up for the $22.6 billion they lost in...