How do interest rates impact hedge fund strategies?

Back in November 2022 we undertook a piece of research on behalf of our clients that looked at how hedge funds performed in low interest rates vs. high interest rates environments.

At the time this research showed that almost all hedge fund strategies did better, producing higher returns, in an elevated-rates environment versus periods of lower-rates.

As we are now in the midst of another era of interest rate policy, PivotalPath’s client base of over 100 allocators with a combined $600bn invested in hedge fund strategies, have asked us to revisit our initial research, in order to test its findings after a period of sustained higher rates and examine how a shifting rates environment could shape their investment horizon over 2026 and beyond.

The Federal Reserve has recently begun a rate-cutting cycle, implementing a sequence of 25-basis-point cuts in September, October and December 2025, as it responds to changing economic conditions.

These latest interest rate changes, as well as the shifting narrative around rates in the post-Covid-era, have informed a significant portion of the news coverage we consume - and for good reason. As the fundamental building blocks of financial valuation, rates affect the performance of the stock and bond markets, savings, mortgages, and many other aspects of our lives. Importantly, it is also in the interests of allocators and managers alike to understand how a changing rates environment can impact funds at both an individual strategy level and as components of institutional investors’ portfolios.

With this question in mind, back in November 2022 - in a very different rates environment - we conducted an analysis, on behalf of and requested by our clients, on how interest-rate regimes can impact hedge fund strategy performance. This research found that almost all hedge fund strategies generally did better, producing higher returns, in an elevated-rates environment versus periods of lower-rates.

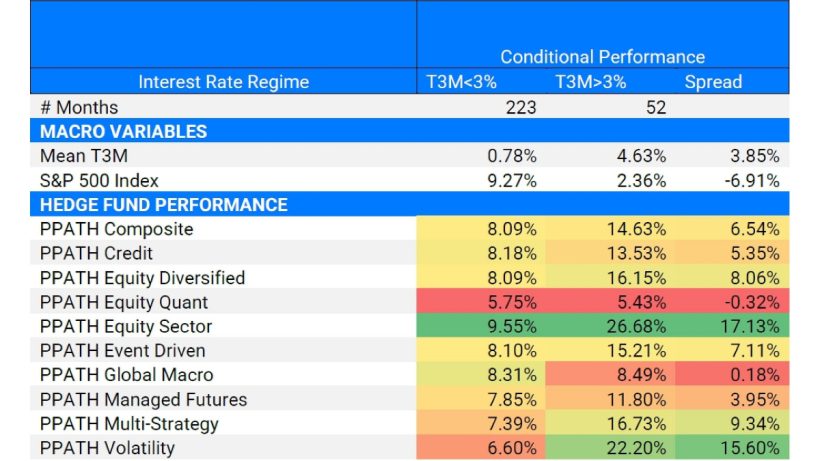

Fig. 1: Original In-Sample analysis (January 2000 to November 2022)

*risk-free rate = 3-month Treasury Bill Rate ** All returns are annualized

***Data from January 2000 to November 2022

As we now enter a changing era, PivotalPath’s client base of over 100 allocators with a combined $600bn invested in hedge fund strategies, have asked us to revisit our initial research, in order to test its findings after a period of sustained higher rates and examine how a changing rate environment could shape their investment horizon over 2026 and beyond.

To conduct our first study, we used our complete (>$3tn in hedge fund AUM) and representative set of hedge fund data to open a unique window into evaluating strategy performance across any regime. The PivotalPath suite of Hedge Fund Indices and our new Regimes tool (see About Us section), enabled us to directly analyze the performance of hedge fund strategies relative to interest rate levels using the 3-Month Treasury Bill rate (T3M) as a proxy for the risk-free rate.

In an environment of rising and now falling (although still elevated) interest rates, this data can be very informative for asset allocation decisions. For the purpose of our current study, we have defined the analysis we did in November 2022 as the In-Sample Period. And the period between December 2022 and December 2025 as the Out-of-Sample Period.

The table above (Fig 1.) uses data from January of 2000 to November of 2022 and computes annualized returns for each PivotalPath Hedge Fund Index and the S&P 500 Index to observe differences in performance when rates were above and below 3%.

PivotalPath’s original analysis showed, generally, that higher rate environments have coincided with significantly better outcomes for hedge funds. Interestingly, this was not the case for the S&P 500 Index in our In-Sample Period, which exhibited a large difference in performance, generating ~7% less per annum when rates were above 3% vs. when they were below.

In addition, during the 23-year In-Sample Period, we also observed several notable relationships between rate regimes and hedge fund strategy performance outlined in the below key findings:

Key findings from PivotalPath’s November 2022 In-Sample research:

- The PivotalPath Hedge Fund Composite Index not only generated over 650bps more in periods of high rates, but it increased its excess return above the risk-free rate from 7.3% to 10%, an improvement of 270bps.

- Equity Sector strategies showed the largest improvement in high-rate environments.

- The PivotalPath Volatility Index, which includes primarily tail risk strategies, thrived in higher rate environments during the In-Sample timeframe, returning 22% per annum when rates were above 3% vs. 6.6% when rates were below 3%, along with increased excess returns of almost 12% per annum.

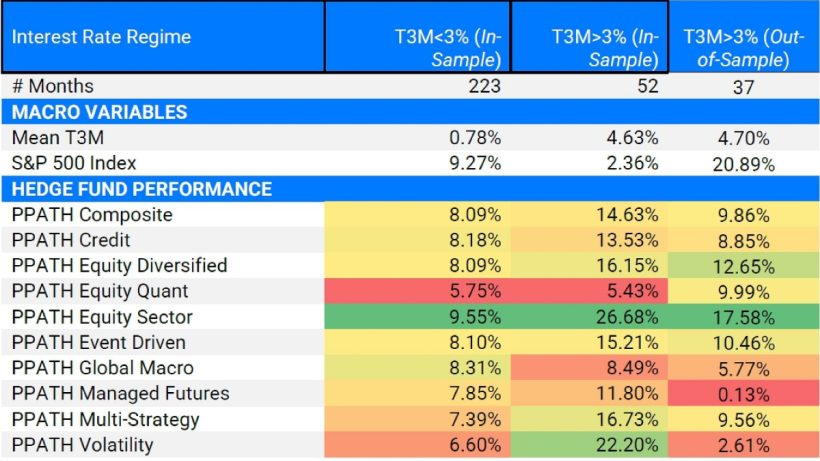

Updating for the current environment (Fig. 2 and Fig. 3) and after a now sustained period of higher rates our latest analysis incorporates the period from December 2022 through December 2025, which we refer to as the Out-of-Sample Period.

During all 37 months of this window, the T3M rate remained above 3%, creating a consistent high-rate environment suitable for comparison to the historical In-Sample results.

Fig. 2: Table Comparing In-Sample and Out-of-Sample Data

*risk free rate = 3-month Treasury Bill Rate

** All returns are annualized

*** In-Sample data from January 2000 to November 2022

**** Out-of-Sample data from December 2022 to December 2025

Relative to the In-Sample Period our current findings clearly reconfirm the initial conclusion that hedge funds generally do better in higher rate environments. However, several divergences and differences do emerge in the Out-of-Sample data, which are worth highlighting and explaining in the key findings below:

Key findings from PivotalPath’s current Out-of-Sample research:

- Equity Quant strategies have flipped from a high-rate underperformer to a high-rate outperformer.

- In our In-Sample (2000–2022) data, the raw performance of the Equity Quant space was slightly lower when rates were high (a negative 0.32% spread).

- While in our Out-of-Sample (2022–2025) data Equity Quant has been one of the top performers in high-rate months, with an annualized net performance of 9.99%.

- This is a significant regime shift across all strategies and could be explained by the In-Sample Period’s spells of high rates often coincided with ‘crisis-style’ market conditions, characterized by macro shocks, correlation spikes, and rapid de-leveraging.

- That environment was challenging for many equity quant strategies because the cross-sectional relationships they rely on can break down, crowding unwinds can dominate, and diversification benefits shrink.

- In the Out-of-Sample Period, rates stayed above 3% but the market texture was different with more persistent dispersion, frequent rotations, and more positioning-driven moves. That is a friendlier setup for modern equity quant firms, especially after many teams tightened their playbooks post-2022.

- Add the structural backdrop of mega-cap concentration making the index look calmer than the cross-section, and equity quant had more opportunities to harvest relative moves, helping it flip from a high-rate laggard In-Sample to a high-rate outperformer Out-of-Sample.

- It is interesting to note that another significant shift in the In-Sample and Out-of-Sample period is the behavior of the S&P 500, which lagged during high-rate environments in our In-Sample Period, but has soared in our current Out-of-Sample Period with annualized returns of 20.89%.

Read the full article here by PivotalPath