Below is a summary of the market indicators PivotalPath uses to better understand hedge fund performance. The data and analysis capture the monthly and year-to-date direction of global equities, U.S. equity sectors, notable asset classes, as well as equity factors.

In addition, our own current event-factors will identify other investment themes discovered through regular dialogue with hedge fund managers.

The commentary on this data highlights what we deem to be important market changes and positions us to analyze their effect on hedge fund performance. We share this monthly report with our clients to provide further insight into the PivotalPath research process.

Introduction

January did not deliver the clean ‘new year, new mood’ reset some were hoping for.

- Markets moved, but the experience of trading them felt jumpier, and it was a month where big dates, not big convictions, set the rhythm.

- The calendar did most of the directing: US CPI (13 Jan), the Bank of Japan meeting (22–23 Jan), and the FOMC decision (28 Jan).

- Each one reminded managers that 2026 may be less about a smooth easing story and more about stop-start progress, with markets quick to overreact and then correct.

- This meant manager conversations were less about finding the next grand theme and more about staying involved without getting caught wrong-footed.

- As we start a new year, managers are coalescing around a sentiment that we remain in an incredible risk-on cycle, against the backdrop of an unstable geopolitical environment.

- Currently they are not necessarily moving in tandem, but the right (or more aptly, wrong!) geopolitical shock could trigger a fast de-risking that could last for some time, without much room for maneuvering.

- One macro manager described it as: “There are lots of moving parts and our ability to manipulate the economy has been emasculated by events outside of the US.”

The Fed’s interest rate decision delivered the no drama outcome, with the expected hold of the policy range at 3.5%–3.75%, keeping the message cautious and data-led.

- For managers, this reinforced a familiar approach of don’t try to be a hero on one meeting; make money by reacting well to the path and some of the second-order effects that follow.

Japan quietly moved back toward the center of the macro story.

- The BoJ kept policy steady, leaving the overnight rate around 0.75%.

- But even with no change, Japan still mattered. Managers spoke about it less as a headline and more as a pressure point as when Japan shifts, even slowly, it changes how global rates behave and how currency hedges get put on and taken off.

- That makes it a useful place for macro funds to hunt for moves that don’t depend on the US equity tape.

Later in the month, politics put a sharper edge on the policy backdrop.

- On 30 January, Kevin Warsh was nominated to succeed Jerome Powell, pulling the future shape of the Fed a little closer to the day-to-day trading conversation.

- Most managers have yet to treat it as an instant regime change. Instead, seeing it as a reminder that policy can become a moving target and that owning some protection can be a sensible move.

Normal January mechanics did the rest.

- The month loaded risk onto specific days, and managers adjusted accordingly, taking less size when uncertainty was highest, and more willingness to pay for protection when the price was tolerable.

- As one PM put it, January’s job description wasn’t “be aggressive,” it was “be involved, but don’t be naïve.”

The recurring worry from 2025 didn’t disappear.

- Crowding still sat in the background. When too many investors own the same winners, even a small wobble can trigger a rush to cut risk.

- In January, these triggers felt more calendar-driven. Big dates gave portfolios obvious moments to trim, hedge, or press and when lots of people do that at once, ordinary moves can start to feel oddly coordinated.

- Crowding, policy uncertainty, and Japan’s slow shift were the three themes that came up most in January conversations.

- A pause isn’t a promise. Holding rates steady can calm the tape, but it doesn’t remove the two-way risk in inflation and jobs data.

- Japan is a source of tradable tension again. Even when policy is unchanged, the market trades the knock-on effects for global rates and currencies.

- Crowding remains the quiet accelerant. The more everyone owns the same thing, the more quickly routine volatility can turn into forced selling.

At a fund strategy level, January’s high-level trends looked like this:

- Multi-Strats: steady compounding, with platforms trying hard to ensure their diversification was genuine and not just different expressions of the same idea.

- Global Macro: a good month for managers who traded the sequence of CPI, BoJ, the Fed, and then the late-month politics, rather than staking everything on one prediction.

- The CPI 0.3% increase reinforced the “no straight line” inflation backdrop. Certainly not a blow-up of inflation, but firm enough to keep rate-cut optimism from getting too easy.

- Macro managers still see “spectacular” times for the space over next few months, as the US plays politics with the economy, foreign rates stay competitive with domestic rates, Japan potentially flirts with hikes, while stocks stay near record highs against the backdrop of a bond market in a potentially “weird place.”

- Equity Long/Short: more stock-by-stock opportunity than index drama with managers leaning on cleaner pairs and tighter underwriting instead of swinging net exposure around.

- Quant: more focus on discipline where signals got messy around big event days; less appetite for forcing trades in noisy conditions.

- Managed Futures: better when trends held long enough to ride, trickier when policy headlines interrupted the move.

- Credit: still about carry, but with a little more respect for “what if something breaks?” given tight spreads and the way liquidity can vanish quickly.

- Event-Driven: active but selective. Deals with clean financing felt safer, while anything dependent on perfect conditions got treated more cautiously.

- Across most strategies, January’s shared posture was simple, with funds staying invested, but keeping the downside rules clear, because in 2026, the surprises may come less from markets doing something new, and more from familiar stories becoming harder to trade.

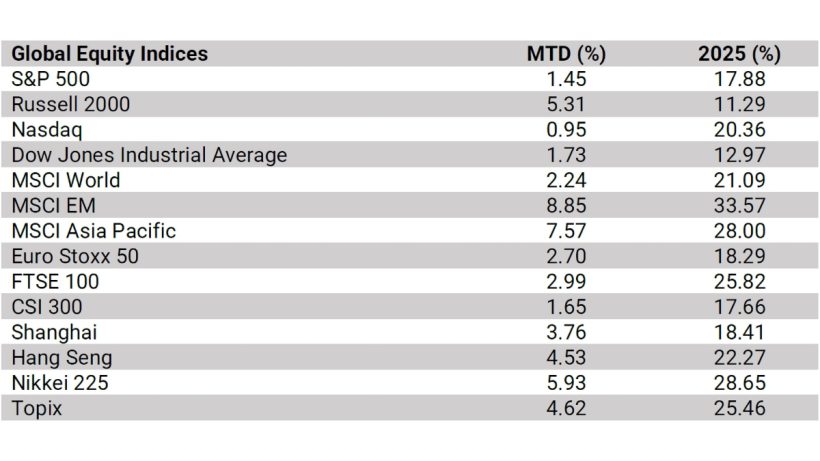

Global Equity Indices (Table 1)

January’s defining feature was that equity leadership stopped feeling so automatic.

- And while the month still produced new highs in places, the way it traded was more stop-start, with rallies built on specific headlines, then paused to see if the next data point would spoil the mood.

- The calendar also kept nudging managers out of the temptation to be on autopilot: CPI (13 Jan), Japan headlines, and the Bank of Japan meeting week (22–23 Jan), all topped by the Fed Day on 28 Jan.

US equities still set the tone, but January’s ‘proof points’ mattered more than December-style momentum.

- The most symbolic moment came late-month when the S&P 500 pushed through 7,000 for the first time, helped by the familiar forces of AI optimism, hopes for rate cuts later in the year, and an earnings season that markets wanted to believe in.

- But hedge funds did not talk about it like a victory lap. The more common line was: “great, but now everything has to behave.”

- One PM explained: When markets hit a big round number, positioning gets a little jumpier, longs take profits faster, shorts get tighter, and hedges get refreshed because nobody wants to be the last person still leaning the same way.

- In January, the S&P 500 hit 1.45%.

- The Nasdaq marked 0.95%.

- Dow Jones Industrial Average achieved 1.73%.

- Russell 2000 surged by 5.31%.

- Tech leadership remained the market’s engine, but January made it feel more conditional.

- The tone around AI kept evolving. It wasn’t necessarily, “is AI real?” markets have moved past that, but it was “who can turn all this spending into earnings without the story getting ahead of itself?”

- That’s the kind of question that creates rotation and pair trades rather than a clean exit, especially as AI losers now have nearly as much Alpha potential as AI winners.

- We also saw a small but telling hedge-fund behavior shift. Several managers described being less willing to run the same big, obvious baskets into key moments.

- Instead, they wanted more “pick your spots” exposure, where they kept a core, but hedged the crowded bits and were ready to add only if the market offered a dislocation.

- One PM put it neatly: “January wasn’t about slamming the brakes, but it was about leaving more room to steer.”

Read the full January 2026 Market Commentary here by PivotalPath