HANetf’s Hector McNeil and Manooj Mistry comment on global ETFs surpassing $20 trillion, with a European perspective.

Hector McNeil, Co-Founder And Co-CEO, HANetf

Hector has built four successful ETF businesses in Europe, including ETF Securities, Boost ETP, WisdomTree Europe, and HANetf

"Global ETFs surpassing the $20 trillion milestone is a significant moment for the industry. In the decades since they first arrived, ETFs have evolved to become one of the most important financial instruments of our time.

"But not only have ETFs themselves evolved, but also the way in which they are used. Once thought of predominantly as shorthand for passive investing, ETFs are now becoming a versatile vehicle for a range of strategies – be it active, options based, or a multitude of others. This shift is transforming the ETF landscape, as more investors recognise the flexibility of the ETF wrapper to offer diverse strategies while retaining the benefits of liquidity, transparency, and tax efficiency.

"Active ETFs, in particular, are on the rise. They challenge old assumptions about ETFs being purely passive and are increasingly popular for those seeking to access dynamic, high-conviction strategies in a more efficient and cost-effective manner. In Europe, assets in actively managed ETFs rose by 86% in 2025 alone.

"As the market evolves, we're seeing that the ETF wrapper has become a tool not just for index tracking but for innovative, thematic plays, fixed income strategies, and much more. At HANetf, we are proud to be at the forefront of this change, offering a diverse lineup of ETFs that reflect this new era of investing."

Manooj Mistry, COO, HANetf

Manooj launched Europe's first UCITS ETFs

"When ETFs were first introduced in North America in the early 1990s and in Europe in the early 2000s, no one envisaged that they would become part of the investment mainstream and that most asset managers would now have – or think they need – an ETF strategy.

"ETFs have transformed the asset management industry in a positive way for investors. Going forward, ETFs will be the only vehicle/wrapper of choice for offering investors liquid investment strategies."

Growth In Europe

Each quarter, HANetf publishes Exchange Traded Europe, an analysis of trends and developments across the global ETF market. The latest key findings are summarised below.

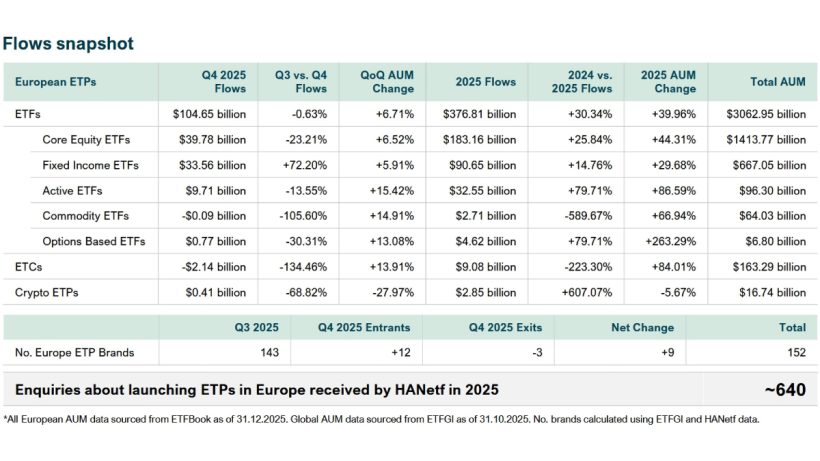

Assets in European ETPs surpassed $3.2 trillion. ETFs added $376.81 billion in 2025 to reach $3.06 trillion. Core equity ETFs contributed significantly to the flows ($183.16 billion) while fixed income ETFs added $90.65 billion.

Key data:

- European ETF market surpasses major milestone: European ETFs are now over $3 trillion AUM, increasing 6.71% in Q4 and 39.96% for the year. ETPs in Europe grew 41.30% overall, beating the growth of US ETFs (27.7%) by approximately 49.1%.

- Core equity ETFs surpass $1.4tn: Core equity ETFs reached $1.41 trillion in assets, with $183.16 billion net flows in Q4. This was slightly down from their Q3 gains, but they ended the year with an overall 44.31% increase in assets.

- Fixed income ETFs close 2025 strongly: Flows into fixed income ETFs were 72.20% higher in Q4, and ended the year with 29.68% growth.

- Active and options based ETFs see strong growth: AUM in active ETFs increased 86.59% in 2025, beating 2024's 68% growth and hitting a record $96.30 billion. Options based ETFs more than tripled their assets in 2025 to $6.80 billion.

- No. European ETP brands continues to rise: In Q4 2025, there were 12 new entrants to the European ETP market and 3 exits, bringing the total number of brands to 152. HANetf accounts for approximately 20% of these.

- Surge of enquiries to launch active ETFs: Of the approximately 640 enquiries received by HANetf, around 80% were regarding the launch of active ETFs.

Read the full report to discover quarter-on-quarter data, ETF market developments, the most exciting themes, and how various asset classes fared across 2025.

About HANetf

HANetf is a leading European ETF platform that has built four successful ETF businesses in Europe. The company publishes Exchange Traded Europe quarterly, providing analysis of trends and developments across the global ETF market.