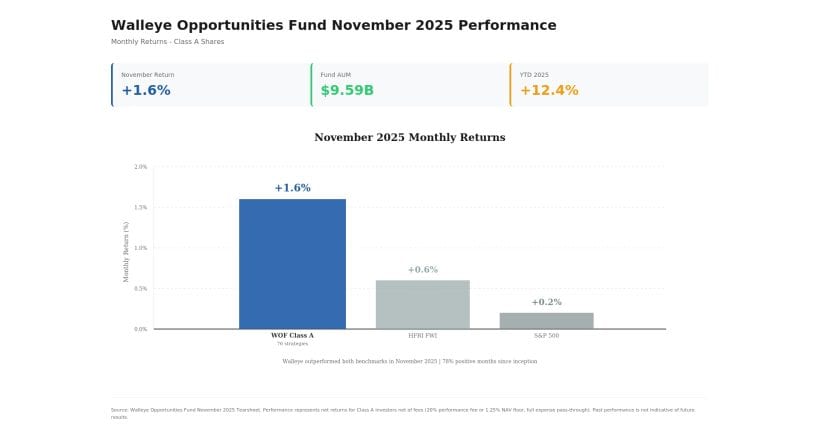

The Walleye Opportunities Fund returned 1.6% net across all of its restricted and unrestricted share classes in November 2025, bringing year-to-date performance to 12.4%, according to a letter to investors reviewed by Hedge Fund Alpha. The multi-strategy hedge fund continues to demonstrate strong risk-adjusted returns through its diversified approach across approximately 76 strategies.

Performance by Share Class

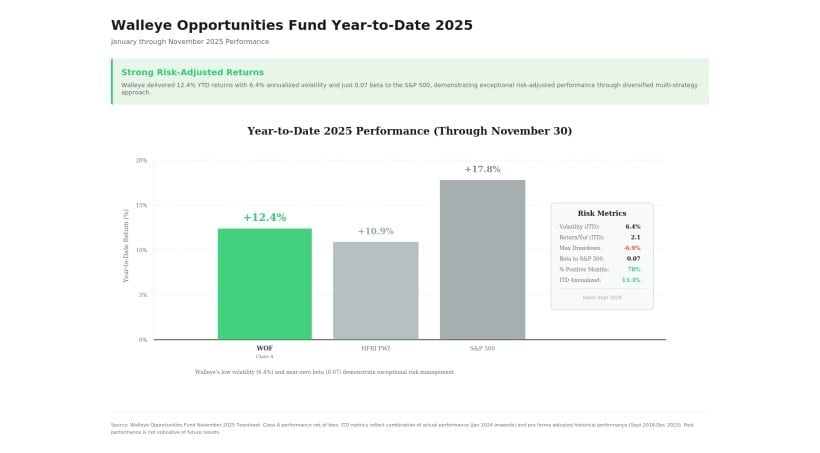

Class A (unrestricted) posted 12.4% year-to-date returns through November, while Class B (both restricted and unrestricted) delivered returns in the 12.9% range for the year. The newly launched Class C shares – which began trading on August 1, 2025 – have generated 12.4% returns year-to-date for both restricted and unrestricted investors.

Since inception, the fund has delivered exceptional long-term results with a 13.3% annualized return, significantly outperforming both the HFRI FWI (6.8% annualized) and the S&P 500 (14.4% annualized) on a risk-adjusted basis. The fund has an inception-to-date Return/Volatility ratio of 2.1 and maximum drawdown of just -6.9%.

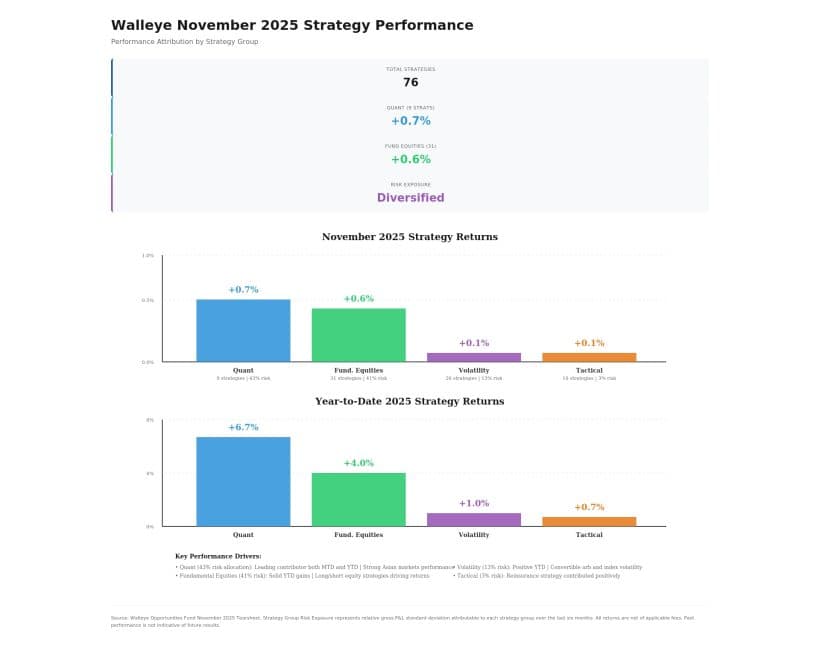

November Strategy Attribution

In its November update obtained by Hedge Fund Alpha, Walleye reported positive contributions from all four of its main strategy groups, with 76 total strategies contributing to overall performance.