RPD Opportunity Fund commentary for the month ended December 31, 2025.

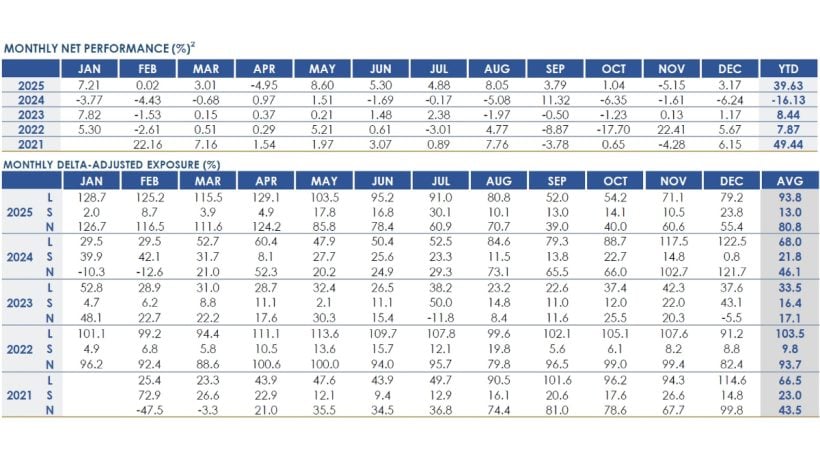

The RPD Opportunity Fund gained 3.17% net in December, ending 2025 up 39.63% net. This year represented a recovery following the Fund’s challenging 2024; however, this outcome was not driven by a broad recovery in value, which, despite strong performance in the general market indices, continued to underperform in 2025, but by the rerating of our high-conviction investments that entered the year at depressed valuations. Performance was driven by active security selection rather than factor exposure.

The estimated performance figures net of fees as of December 31, 2025

| Month | Year to Date | Inception to Date | Annualized Net Return | |

|---|---|---|---|---|

| RPD Opportunity Fund | 3.17% | 39.63% | 104.71% | 15.71% |

| BarclayHedge Equity L/S | 0.84% | 13.80% | 46.69% | 8.09% |

| S&P 500 | 0.05% | 17.87% | 98.14% | 14.92% |

| Russell 2000 | -0.62% | 12.76% | 27.91% | 5.13% |

Inception date - February 1, 2021

Market leadership in December remained narrow, with index performance supported by a limited group of large-cap, momentum-driven stocks, while dispersion across individual securities remained wide. Within the portfolio, two positions that had detracted earlier in November contributed in December; however, these moves represent only a partial recovery. These holdings remain priced at depressed valuation levels relative to improving fundamentals and continue to reflect conservative expectations, despite being among our highest-conviction investments.

Outright long exposure is currently at its highest level in a long time, reflecting the opportunity created by the extended selloff in application software. Periods of broad enterprise software dislocation have historically produced some of the Fund’s strongest long-term outcomes, and software has been one of our most consistent contributors. We do not believe this cycle is materially different. Given the higher outright exposure and increased concentration in core positions, we expect the Fund to be more volatile than in periods when exposure was more muted. We are comfortable with this positioning, and we welcome the volatility it creates opportunity, given the fundamental view and valuation support across these holdings.