Praetorian Capital's commentary for the fourth quarter ended December 31, 2025.

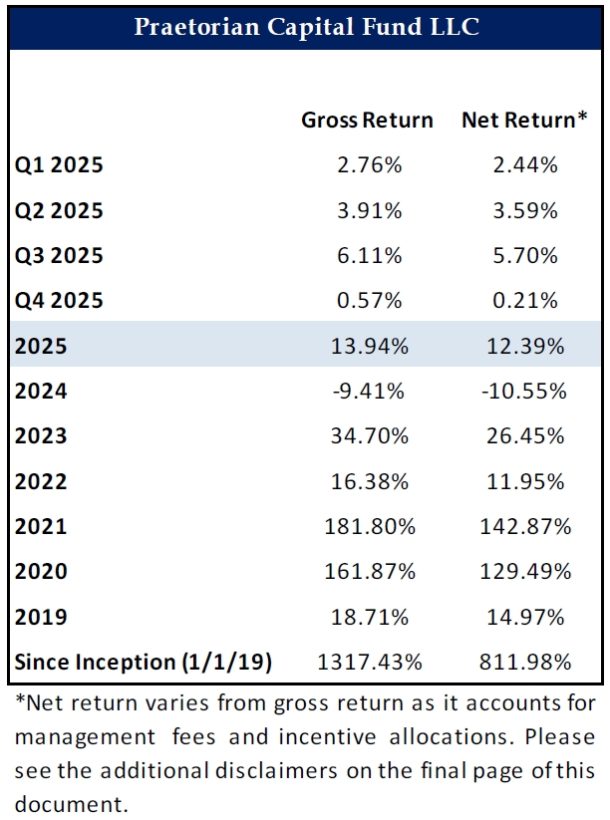

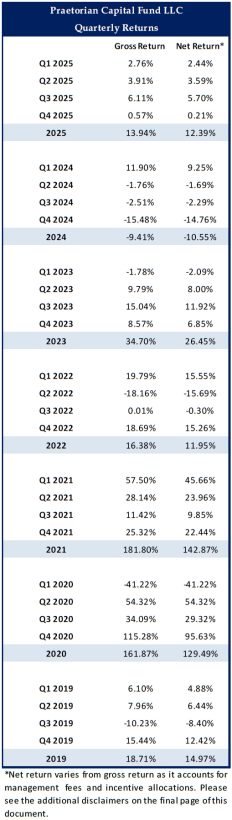

During the fourth quarter of 2025, Praetorian Capital Fund LLC (the “Fund”) appreciated by 0.21% net of fees. For the full year, the Fund appreciated by 12.39% net of fees. Since inception, the Fund has compounded capital at an annualized net rate of 37.12%. A dollar invested at inception would be worth approximately $9.12 net of fees, after 7 years invested in the Fund.

Given the Fund’s concentrated portfolio construction and focus on asymmetric opportunities, I anticipate that the Fund will be rather volatile from quarter to quarter. During the fourth quarter, core portfolio positions experienced a moderately positive return, while the Event-Driven book detracted from performance. For the full year, our core portfolio positions in aggregate appreciated, while our Event-Driven book generated a slightly positive return. As I have noted many times, the two strategies are designed to be complementary and have historically tended to offset one another. During 2025, neither strategy did particularly well. I’m embarrassed and humbled by the returns over the past two years, which are the worst stretch of my investment performance in many years.

As I have mentioned on many occasions, my expectations for this Fund’s performance are bifurcated, and I anticipate that we’ll have many standard years where the Fund’s performance ranges from down teens to up twenties percent on a net basis. With my focus on deep value situations, along with expected gains on the Event-Driven book, the Fund’s return profile should skew positively during a standard year. Interspersed with these standard years will be years where I expect our core positions to dramatically outperform as they catch strong tailwinds, and based on prior Fund history, we are up triple digits on a net basis.

To date, we’ve had five standard years (2019, 2022, 2023, 2024, 2025), and two years of dramatic outperformance (2020 and 2021). To be honest, I would have expected that the ratio would be more balanced by now. That said, as an investor, I can only take what the market gives. I will not force the issue, nor chase themes that are outside of my wheelhouse.

Unfortunately, I am primarily an investor in ‘real economy’ businesses, and almost completely eschew tech investments. As you can imagine, this has made my job difficult, as the ‘real economy’ has mostly been in recession since 2023—while equity markets have mostly levitated on the back of tech outperformance.

This spring, after getting whipsawed by Trump’s Liberation Day nonsense, I chose to dramatically de-gross the portfolio, and go on a self-imposed vacation to think through the world in front of me. How do you invest in a world where the vast majority of the US population is struggling financially, where the vast majority of ‘real economy’ businesses are struggling, and where the political mandate is no longer to try and grow the economy??

For most of the past century, politicians were elected if they could bring prosperity to voters. Now, in a Uniparty political system, all that matters is propping up the numerous asset bubbles. Politicians theoretically could grow the economy, but that is a political decision that they’re loathe to make.

Think back to 2022 when our economy actually started to accelerate as it came out of the COVID funk. Things were booming, restaurants were full, retailers reported great numbers, and wages for most workers accelerated in real terms for the first time in decades. However, it wasn’t so great if you owned assets. Tech stocks crashed, real estate got into trouble as interest rates increased, Private Equity panicked as wage growth hurt margins, and a few banks failed as they took on too much duration. As a nation, we chose to bail out those with risk assets at the cost of everyone else. The Fed rapidly raised interest rates, the government doubled down on ESG nonsense to slow economic growth, and within a few quarters, the rate of change turned negative.

At the time, I should have recognized this for what it was. Instead, I kept believing that politicians would undertake policies to grow the economy, after tamping down on inflation a bit, as general prosperity was historically necessary for re-election. I now realize the folly of my misunderstanding. We’re going to run the economy to maximize asset values. Everything else is collateral damage.

As I stewed through this collage of information, I kept asking myself how to invest in a world where my universe of investible companies (those with cash flow at low valuations) would likely continue to suffer. Eventually, I returned to first principles—invest where the tailwinds are.

In a world where we continue to blow bigger bubbles to bail out the prior bubbles, there are a limited number of sectors to focus on, while remaining disciplined as a value investor. However, there are some great trends out there, and I’ve doubled down on them over the past year. Specifically, I want to own everything at the nexus of these bubbles—the transactional and croupier businesses, including brokers, exchanges, and other market intermediaries. We own companies where the 0.1% will choose to spend more of their time when their cities devolve into chaos while escaping taxes. If you haven’t been to Dubai, Cayman, Hong Kong, Miami or the Florida Panhandle lately, you may not appreciate how severe the 0.1% refugee crisis has become. There simply isn’t enough high-end real estate for everyone fleeing their former homes. I want to own the beneficiaries of precious metal appreciation, as you can’t have asset bubbles without endless fiscal recklessness and monetary debasement. In a similar vein, while the West collectively faces decades of terrible past decisions, along with the imbalances that they’ve endangered, many Emerging Markets have put their houses in (relative) order. As capital flees the over-indebted West, the Dollar should decline, lifting a great weight off the shoulders of the Emerging Markets. We have exposure to those countries that are acting like adults, or are nearing elections where adults will hopefully take over.

It's an eclectic book, some of which we owned before Liberation Day, and much of which we purchased after that event—frequently at prices below the lows of Liberation Day. One of the unique aspects of my investing strategy is that I tend to not own the large cap equities that make up the popular indexes. Our names actually tend to be rather uncorrelated. As a result, I don’t have to worry about where the overall market goes, nor fear missing out when I’m sitting in cash. Instead, I know that through a bit of patience, I can rebuild a new book of fresh ideas. At the end of December, the Fund was 101.4% exposed on the long side, which is only slightly below the 115% to 125% range that I target. More importantly, if January of 2026 is any indication, we’re in themes that are finally ‘working.’

You may ask how it is that a guy who’s unusually bearish, can run a book that’s more than 100% long. The answer is that my sectors seem to be doing well despite a global recession. You may say they’re doing well strictly because of the imbalances in the world. Sure, if the market were to crash, I’d expect a drawdown, but the resulting liquidity injection would come rapidly, and likely propel our names meaningfully higher. The world economy may suffer from too much liquidity, but that won’t stop them from applying far more. One day, this will be terrible for duration assets, but thankfully that is not where we’ve clustered our exposure.

In my Q3 2025 letter, I detailed some more of my thinking on these topics. I am now three months further along in this journey and feel increasingly confident that my forced sojourn from the market was the right decision. Rather than continue to nurse along a bunch of ‘real economy’ stocks that were floundering, we’ve rebooted for the endless liquidity pulses that seem almost inevitable. While I expect a crash, I feel some safety given how far our names are from the nexus of where the current bubbles lie in tech/Private Equity/Private Credit/CRE/VC. Bubbles are funny, once they crash, they take years before they can reinflate. Humans instead go looking for new bubbles to chase. Hopefully, we’re long some of those. If not, we have strong tailwinds at our backs.

Position Review (top 5 position weightings at quarter end from largest to smallest)

Emerging Markets Basket

For the past decade and change, Emerging Markets have been in a relative bear market, as investor capital has migrated to US markets. In the process, many emerging markets have gotten quite cheap when looking at them from a valuation perspective. This Fund has a sweet spot for cheap assets, but Emerging Markets have been cheap for quite some time now. You could have said the same thing years ago and likely be sitting on paper losses today, while having tied up capital. What you need is a catalyst that unlocks this value. I believe that catalyst is a potential decline in the US Dollar, tied to policy changes emanating from the Trump Administration. For MAGA policies to work, the US needs to follow a weak Dollar policy. At the same time, Emerging Markets, which frequently borrow in US Dollars, are hamstrung by a strong dollar, but a weakening dollar is a boon to their economies. As a result, I’ve built up positions in various Emerging Markets that are highly impacted by the US Dollar, with the view that a weakening Dollar should be a catalyst for asset values.

Precious Metals Basket

In an inflationary world with loss of faith in Central Banks, precious metals tend to do well. We own two companies that should be beneficiaries of precious metals either appreciating or at least staying at elevated prices. Neither of these companies are directly in the mining business, which is risky and capital intensive—though one is a service provider to miners.

St. Joe (JOE – USA)

JOE owns approximately 167,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE may grow revenue at a rapid rate for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at an attractive multiple on Adjusted Funds from Operations (AFFO), while substantial asset value is tossed in for free.

Besides the valuation, growth, and high Return on Invested Capital (ROIC) of the business, why else do I like JOE? For starters, land tends to appreciate rapidly during periods of high inflation. More importantly, I believe we are witnessing a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax-the-rich scheming will launch JOE shares higher, and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

Refiners

Refiners have suffered for over a decade (excluding the immediate aftermath of the Ukraine war), leading many Western refiners to shut, rather than invest substantial capital in upgrades to meet spurious mandates. Meanwhile, China flooded the world with refined product, destroying economics for everyone. Over the past few years, China has chosen to shut so-called teapot refiners and pivot larger refiners to petrochemicals. At the same time, demand for refined products has continued to grow, and for the first time in very many years, the crack spread has become elevated on a forward basis, indicating a tightness in the markets.

On the supply side, we have relatively good visibility in terms of which new refineries will come online, with some uneconomic ones still slated to shut. On the demand side, most data providers assume a rather balanced market with demand growth staying anemic. I don’t think this is a bad assumption, as the world is in a recession.

However, should there be economic growth, even just some wisps of growth as the Dollar declines and Emerging Markets (which have huge marginal propensity to consume petroleum products as they see growth) recover, energy demand could exceed estimates.

This had previously been my energy thesis, basically that 7 billion people want the same standard of living that 1 billion in the First World have today. Now, I believe I’ve found a better way to express it as it takes many years to build a new refinery. Meanwhile new oil supply can come online far faster, leading to a bottleneck that extracts most of the pricing economics in a demand recovery.

We own diversified refining companies with clean balance sheets, a strong propensity for buybacks, and a valuation that is at a substantial discount to replacement cost of their refineries. I think this trade works if governments return to pro-growth policies, or the US Dollar weakens enough that EM energy demand can increase.

Think of this position as a hedge should global economic growth accelerate.

Marex (MRX – USA)

As mentioned, we have a croupier basket, where many of our stock exchange and brokerage positions are lumped into the Emerging Markets category. While Marex is headquartered in the UK, itself an Emerging Market these days, I’ve chosen to break MRX out separately, as so much of the business focuses on trading solutions for mid-market commodities firms, hedge funds and futures speculators in the Developed Markets.

Marex continues to take market share from bulge bracket firms who are unable to offer competitive levels of services to mid-market firms, while consistently purchasing smaller players who cannot afford the increased compliance costs of participating in a global market.

My view is that in the increasingly volatile and financialized markets of the future, CFOs will feel a need to hedge not just commodity risks, but currencies, interest rates, freight rates, weather derivatives and all sorts of other products that may not even exist today. As the CFO, you get a large bonus for hedging correctly, and few penalties for hedging poorly, since Adjusted EBITDA tends to adjust the losses away. With retail investors increasingly fixated on gambling, why shouldn’t the C-Suite do the same??

Meanwhile, Marex trades at a high single-digit 2026 estimated earnings multiple, has grown earnings at an impressive rate, and has consistently earned unusually high returns on equity, despite constantly reinvesting in the business. I see this as something of a long-term compounder that overlaps in many of my favorite themes, with many tailwinds and opportunities to continue to consolidate a sector with few scale competitors for M&A opportunities.

Returning to markets, the past two years were frustrating. I failed to recognize why my sorts of companies were suffering, and I kept assuming that with time, policymakers would adjust course and fix the economy. I now recognize things for what they are, and we’ve rebooted the portfolio into names that mostly do not need GDP growth to prosper. As mentioned, if January is any indication, the change is ‘working.’

Turning over to operations, Praetorian is coming off a foundational year that included the completion of a full Operational Due Diligence review by a best-in-class firm as well as the introduction of our ISINs for our Cayman offshore fund, enabling offshore investors to place trades and settle directly into their existing custodial infrastructure.

Lastly, during 2025 we did our first client-only conference call. We’ll be hosting another on February 17, 2025 at 2pm EST. This call will be open to all current clients and will provide updates on our current positions, macro and thematic outlook, along with a live Q&A session. Given that this letter gets posted publicly, we will send all clients a direct email with more information and a registration link.

I want to thank you again for your investment with me. We’ve had a great run at this Fund, and in many ways, we were overdue for a rough patch. Hopefully, this will not be repeated for quite some time.

Sincerely,

Harris Kupperman

Founder & Chief Investment Officer

Praetorian Capital

Read more hedge fund letters here