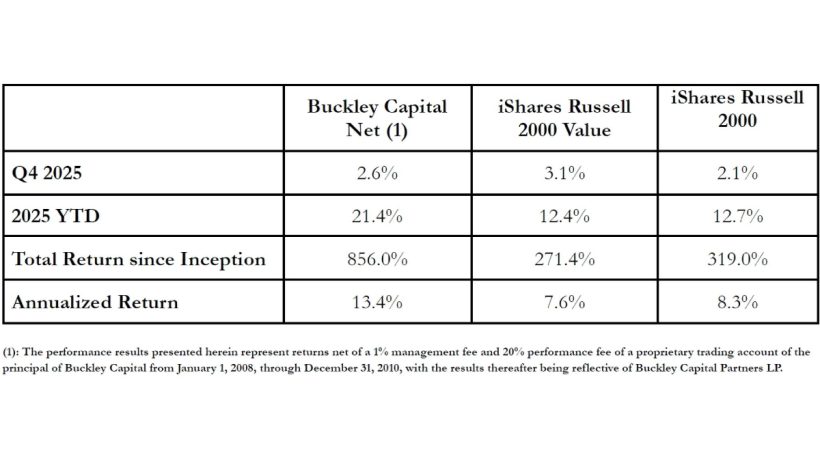

Buckley Capital's letter for the year ended December 31, 2025.

We had a good year in 2025, beating both of our benchmarks. Even so, the current market environment continues to exhibit wide dispersion between prices and intrinsic values, particularly in small- and mid-cap equities. While broader indices appear increasingly driven by macro narratives and narrow leadership, we remain focused on identifying company-specific inflection points where fundamentals are improving materially but remain underappreciated by the market. Periods of uncertainty and dislocation continue to be fertile ground for our approach, allowing us to build meaningful positions in high-quality businesses at valuations that we believe significantly understate long-term earnings power.

Across the portfolio, we are seeing a recurring dynamic: businesses that endured temporary setbacks, structural transitions, or misunderstood accounting are now entering phases of normalization, maturation, or acceleration. In many cases, consensus expectations remain anchored to backward-looking results, while the underlying businesses are positioned for meaningful improvement over the next 12-24 months. Our investment process is designed to exploit these gaps between perception and reality, with an emphasis on downside protection and asymmetric upside.

The positions discussed below represent some of our highest-conviction ideas today. While the specific catalysts differ, each reflects our core philosophy–applying a private equity mindset to public markets, concentrating capital in businesses with durable competitive advantages, and allowing time and execution to unlock intrinsic value.

Basic-Fit: BFIT

Basic-Fit, the dominant low-cost gym operator in Western Europe, is our largest position today. At current prices, it represents one of the most asymmetric opportunities in our portfolio.

Under founder-CEO René Moos, the company built a highly standardized, low-cost gym model that delivers an attractive price-to-value proposition for members and high incremental returns on capital for shareholders. However, in France, Basic-Fit’s largest market, the company has suffered a long hangover related to pandemic closures, shifting regulations, and delayed cohort maturation. Clubs opened during 2020–2022 underperformed historical payback and ROIC targets, dragging on results through 2023 and 2024. The company consistently fell short of investor expectations, compressing the stock’s multiple and dampening sentiment.

Consensus 2026 EBITDA estimates have fallen to approximately €390 million, down sharply from ~€450 million prior to management’s announcement of a €35 million temporary investment in staffing to allow French gyms to operate 24/7 under existing labor laws. We think that will change quickly, as management recently guided to a midpoint of €425 million of EBITDA in 2026.

While the market remains anchored to backward-looking disappointment, we feel strongly that 2026 will be the inflection year for Basic-Fit as it enters a period of beat-and-raise execution. Importantly, clubs opened since 2023 have reverted to pre-pandemic performance, which both proves the resiliency of the company’s business model and places clear “bookends” around the problematic cohorts. Moreover, the lagging 2020-2022 cohorts continue to improve. In addition, we believe the company’s temporary €35 million staffing investment in France is widely misunderstood by the market, which has led investors to materially understate the company’s normalized earnings power. Finally, Basic-Fit benefits from a powerful cohort-maturation tailwind: As of year-end 2024, 37% of clubs were immature, naturally setting up EBITDA growth as mature clubs generate significantly higher EBITDA than brand new clubs. By the end of 2026, the system should approach ~1,775 clubs, with a much larger proportion contributing mature-level profitability.