Hedge fund managers the world over are frequently among the most philanthropic people in the world. For example, Omega Advisors founder Leon Cooperman and his family have signed The Giving Pledge, donating hundreds of millions of dollars to worthy causes, including $100 million to the renamed Cooperman Barnabas Medical Center. Leon Cooperman also donates millions of dollars each year through his own foundation.

Founded in 1981 by Cooperman, The Leon and Toby Cooperman Family Foundation focuses on education, health care, Jewish causes and the performing arts. In fiscal 2025, grantees included the Adolph and Rose Levis Jewish Community Center, American Friends of Magen David Adom, Boca Raton Regional Hospital Foundation, Jespy House, New Jersey Performing Arts Center, Robin Hood Foundation, and RWJ Barnabas Health.

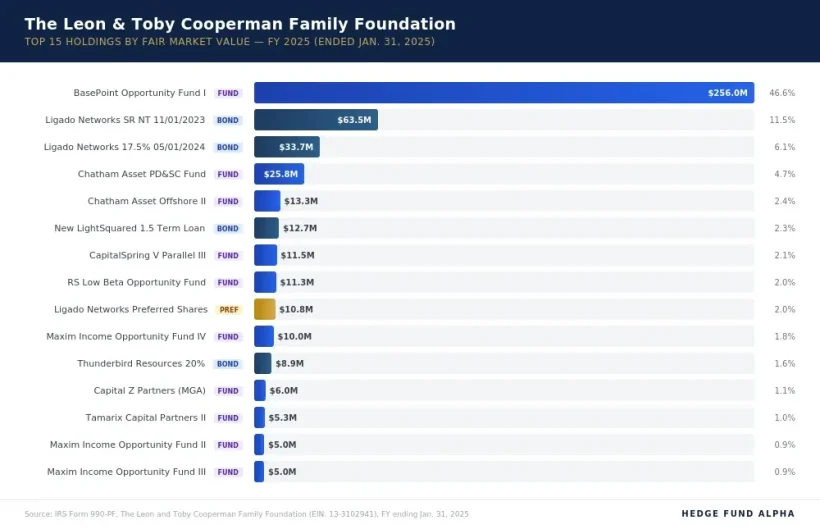

According to the 990-PF for the fiscal year that ended in January 2025, which was filed in December 2025, The Leon and Toby Cooperman Family Foundation had $550 million in assets at the end of the year.

Capital gains and losses

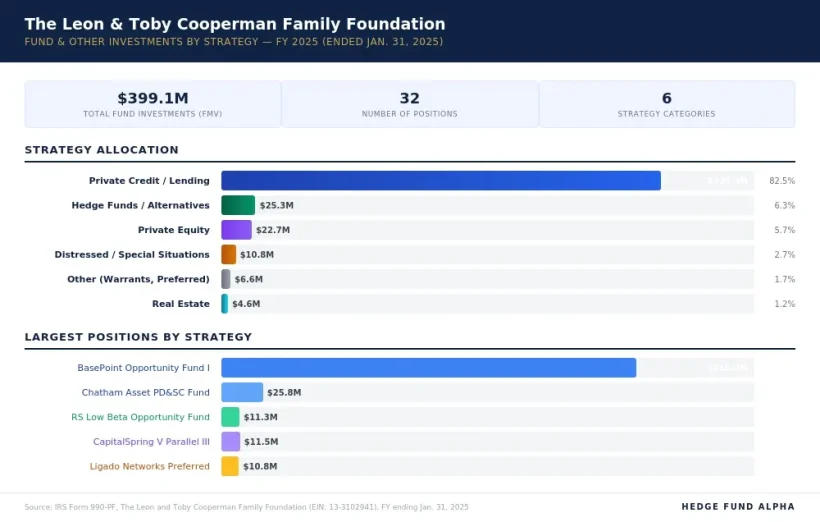

The Leon and Toby Cooperman Family Foundation reported $2.1 million in capital gains from gains in publicly traded securities during fiscal 2025. It also reported gains from its pass-thrus of Capital Z Partners (Fidelis) and Chatham Asset Private Debt and Strategic Capital Fund.

Capital Z Partners is a private equity firm that exclusively targets the financial services industry, aiming to be the first call for financial services firms that face complex challenges or growth opportunities. The Capital Z team sees specialization as essential to success in financial services investing due to unique dynamics in the industry.

They include the fact that typical leveraged buyout structures can’t be employed and the need for a full-time focus in what’s a highly regulated industry. Capital Z also said generalists can’t properly cover the largest sector of the U.S. economy by corporate revenue and believes that lots of expertise is necessary to evaluate complicated business models that have specialized accounting or valuation methodologies.

Also see: Here Are Leon Cooperman’s Favorite Hedge, PE and VC Funds as of January 2024

The team at Chatham Asset Management consists of leveraged credit specialists who target consistent results across cycles. The firm unites seasoned research capabilities with its established network and institutional infrastructure to invest across high-yield bonds, leveraged loans and special situations opportunities in North America. The firm was founded by Anthony Melchiorre in 2003.